Knowing the current market price is foundational to any trading strategy and serves as the baseline for all trade decisions. This is especially relevant when trading with a PROP365-funded account, as it enables effective order placement—whether you’re using market, limit, or stop orders.

Understanding market price also plays a crucial role in calculating risk-to-reward ratios, a key component of any trading plan. Real-time price data helps gauge supply and demand dynamics, allowing traders to assess market sentiment and adjust their stop-loss and take-profit levels accordingly.

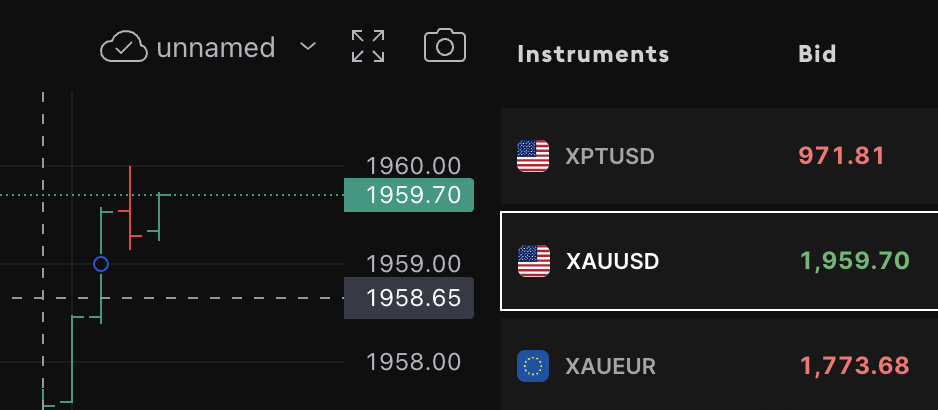

How to Read the Market Price on TradeLocker via PROP365

There are multiple ways to check the current market price:

-

Price Axis on the Chart – The current trading price is highlighted on the price axis of the TradeLocker chart.

-

Instruments Tab – Search for the desired asset in the Instruments tab to view its real-time price.

Why This Matters for PROP365 Traders

-

Historical Comparison: Knowing the current market price allows traders to compare it with past price movements, aiding in predictive analysis.

-

Short-Term Trading Strategies: Day traders and scalpers, particularly those using PROP365-funded accounts, rely on minute-to-minute price changes to execute their trades.

-

Capitalizing on Market Movements: Being attuned to market price enables traders to act quickly on fleeting opportunities.

-

Options Trading: Understanding market price is essential for pricing options contracts and assessing their intrinsic and time value.

By staying informed about market prices, PROP365 traders can enhance their ability to make data-driven and profitable decisions while trading on TradeLocker.

Help Center

Help Center